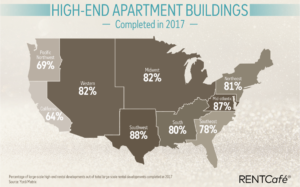

Although it won’t come as a surprise, new data from RentCafé has shown just how saturated the multifamily market is becoming with high-end construction. Just within the last five years, Class A development has gone from half the new construction to well over three-quarters of new inventory in most of the major markets. BAM looks at the RentCafé data, as well as some of the implications of when investors bet heavily on luxury assets in today’s BAM blog…

The Midwest Kicked Luxury Construction Into Gear

According to the numbers, the luxury rental market isn’t left to the coasts. The Midwest has seen a dramatic increase in Class A inventory since 2015. In 2015, 73% of all multifamily construction was high-end, which jumped up to 82% by the end of 2017. In fact, the first part of 2018 saw Chicago receiving only luxury apartment construction.

Metros With Class A Construction This Year

Based on the early numbers available, the following six cities opened only luxury apartment properties the first half of 2018:

Dallas-Ft. Worth

Houston

Kansas City

Charlotte

Detroit

Cleveland, Akron

Top Five Cities With Highest Share of Class A Properties

For 2017 and 2018, the following five cities have the highest share of luxury multifamily properties:

Dallas

Fort Worth

Boston

Las Vegas

Louisville

Some cities have seen a slow-down in luxury rental property construction, such as Austin, Phoenix, Denver, Seattle, and Salt Lake City.

Yet when developers and investors go all-in on Class A assets, what risk does that carry? As we wrote in our previous article, there’s a reason that BAM typically sticks to the “sweet spot” found in workforce housing. For example, during an economic downturn, luxury multifamily properties are less able to weather the storm – they’re often hit the hardest as demand drops and vacancy rates climb. Workforce housing, on the other hand, maintains a steady demand even in times of economic uncertainty, which makes it a less risky investment bet. Workforce housing also provides opportunity for rent growth with often minimal upgrade investment, while Class A properties may have less room for rental growth. As Class A inventory increases, and demand for quality workforce housing remains solid, finding good Class B and C deals may be harder – but in the end, still worth the effort!

BAM Bottom Line: Luxury multifamily properties are increasing in production in many major markets and make up most current new construction. Yet investors should be wary of these properties, as they may not offer the same investment sense and/or security, especially in economic downturns as other asset classes.